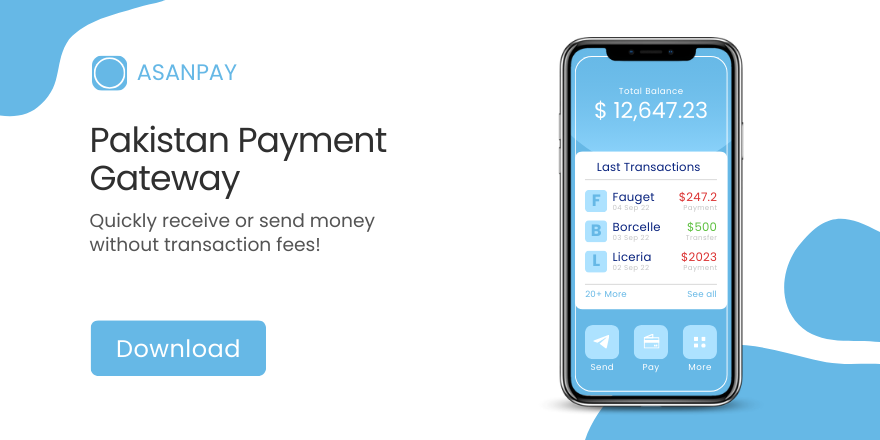

ASANPAY Pakistan Payment Gateway

In today’s fast-evolving digital landscape, the importance of seamless and secure online payment solutions cannot be overstated, particularly for businesses in Pakistan looking to thrive in the e-commerce realm. Enter ASANPAY, a pioneering Pakistan payment gateway designed to simplify transactions while enhancing the user experience for both merchants and consumers. With its user-friendly interface, robust security features, and versatile integration options, ASANPAY is quickly becoming the go-to choice for businesses aiming to streamline their payment processes. In this comprehensive guide, we will delve into the intricacies of the ASANPAY pakistan payment gateway, exploring its features, benefits, and step-by-step setup process. Whether you are a seasoned entrepreneur or a budding startup, this guide will equip you with the knowledge you need to leverage ASANPAY to elevate your business and provide your customers with a smooth, hassle-free payment experience.

Understanding ASANPAY: An Overview

ASANPAY is reshaping the landscape of online transactions in Pakistan, making digital payments more accessible and secure for businesses and consumers alike. Established with the goal of facilitating seamless financial interactions, ASANPAY serves as a reliable Pakistan payment gateway that caters to a diverse range of payment needs, from eCommerce platforms to mobile applications.

At its core, ASANPAY is designed to streamline the payment process, enabling businesses to accept online payments effortlessly. With its user-friendly interface, merchants can easily integrate the gateway into their websites or apps, providing customers with a straightforward checkout experience. ASANPAY supports multiple payment methods, including credit and debit cards, bank transfers, and mobile wallets, ensuring that users can transact using their preferred payment option.

One of the standout features of ASANPAY is its focus on security. The platform employs advanced encryption and compliance measures to protect sensitive customer data, giving users peace of mind as they conduct transactions. Additionally, ASANPAY offers robust support and resources for merchants, helping them navigate the complexities of online payments and enhance their business operations.

Whether you are a small business owner looking to expand your digital footprint or a consumer seeking a convenient way to make online purchases, ASANPAY provides a comprehensive solution that bridges the gap between traditional banking and the digital economy in Pakistan. By understanding the capabilities and advantages of ASANPAY, both merchants and consumers can take full advantage of this innovative Pakistan payment gateway, driving growth and efficiency in the ever-evolving world of online commerce.

Key Features of ASANPAY Pakistan Payment Gateway

ASANPAY is a cutting-edge Pakistan payment gateway that has revolutionized the way businesses in Pakistan handle online transactions. With a focus on user experience, security, and versatility, ASANPAY offers an impressive array of features designed to meet the needs of both merchants and consumers.

One of the standout features of ASANPAY is its seamless integration with various e-commerce platforms, allowing businesses to set up payment processing with minimal hassle. Whether you are using Shopify, WooCommerce, or a custom-built website, the integration process is straightforward, ensuring that you can start accepting payments almost instantly.

Security is paramount in the world of online transactions, and ASANPAY employs advanced encryption and compliance with industry standards to protect sensitive information. Their robust security protocols help build trust with customers, giving them the confidence to make purchases without hesitation.

Another key feature is the support for multiple payment methods. ASANPAY accommodates various payment options, including credit cards, debit cards, and mobile wallets, making it easy for customers to pay using their preferred method. This flexibility not only enhances customer satisfaction but also increases conversion rates for businesses.

ASANPAY also provides detailed analytics and reporting tools that allow merchants to track their sales performance and gain insights into customer behavior. With real-time transaction monitoring, businesses can quickly identify trends, optimize their operations, and make informed decisions to drive growth.

Additionally, ASANPAY is known for its excellent customer support. The dedicated support team is readily available to assist merchants with any inquiries or technical issues, ensuring that businesses can operate smoothly without disruptions.

In summary, ASANPAY stands out as a versatile Pakistan payment gateway that combines security, flexibility, and user-friendly features. Its commitment to enhancing the e-commerce experience in Pakistan makes it a top choice for businesses looking to streamline their payment processes and cater to the evolving needs of their customers.

Benefits of Using ASANPAY for Your Business

When it comes to streamlining transactions and enhancing customer experiences, ASANPAY stands out as a preferred payment gateway for businesses in Pakistan. One of the primary benefits of using ASANPAY is its ease of integration. Designed with user experience in mind, this Pakistan payment gateway seamlessly integrates with various eCommerce platforms, allowing businesses to set up digital payment solutions swiftly without the need for extensive technical knowledge.

Another significant advantage is its diverse payment options. ASANPAY supports multiple payment methods, including credit and debit cards, bank transfers, and mobile wallets. This versatility not only caters to a wide range of customer preferences but also enhances the likelihood of completed transactions, reducing cart abandonment rates.

Security is paramount in online transactions, and ASANPAY excels in this area. The Pakistan payment gateway employs robust encryption protocols to ensure that sensitive customer data is protected. This instills confidence in customers, reassuring them that their financial information is secure, which can help foster customer loyalty and repeat business.

Furthermore, ASANPAY provides real-time transaction tracking and reporting features. Business owners can easily monitor their sales and financial performance, enabling them to make data-driven decisions that can enhance their overall strategy. Additionally, the responsive customer support offered by ASANPAY ensures that any issues or inquiries are promptly addressed, allowing businesses to operate smoothly without unnecessary interruptions.

Lastly, ASANPAY’s competitive transaction fees make it a cost-effective option for businesses of all sizes. By reducing overhead costs associated with payment processing, companies can allocate more resources to other areas such as marketing or product development, ultimately driving growth.

In summary, the benefits of using ASANPAY for your business are clear: from seamless integration and diverse payment options to enhanced security and outstanding support, ASANPAY not only simplifies the payment process but also positions your business for success in an increasingly digital marketplace.

Step-by-Step Guide to Setting Up ASANPAY

Setting up ASANPAY, Pakistan’s premier Pakistan payment gateway, is a straightforward process that can significantly enhance your e-commerce operations. Whether you’re starting a new online business or looking to integrate a more efficient payment solution into your existing platform, this step-by-step guide will walk you through the necessary stages to get ASANPAY up and running seamlessly.

Step 1: Create Your ASANPAY Account

Begin by visiting the official ASANPAY website. Click on the “Sign Up” button to create your account. You’ll be required to fill out a registration form with essential details such as your business name, email address, and contact information. After submitting the form, check your email for a verification link to activate your account.

Step 2: Complete Your Business Profile

Once your account is activated, log in and complete your business profile. Provide information about your business type, registration details, and financial information. This step is crucial as it helps ASANPAY verify your identity and assess your business for compliance with their policies.

Step 3: Choose Your Payment Options

ASANPAY offers various payment solutions, including online payments, mobile payments, and bank transfers. Navigate to the payment options section and select the methods that align with your business needs. Make sure to review the transaction fees associated with each payment type to choose the most cost-effective options.

Step 4: Integrate ASANPAY with Your Website

Next, you’ll need to integrate ASANPAY with your e-commerce platform. ASANPAY provides several integration methods, including APIs for custom platforms, plugins for popular e-commerce platforms like WooCommerce and Shopify, and a simple checkout solution. Follow the detailed documentation provided by ASANPAY to implement the integration smoothly.

Step 5: Configure Your Payment Settings

After integration, navigate to your payment settings within the ASANPAY dashboard. Here, you can set preferences such as currency type, transaction limits, and notification settings. Tailor these options to suit your business model and ensure a seamless customer experience.

Step 6: Test Your Payment Gateway

Before going live, it’s essential to test your ASANPAY integration. Use the sandbox environment provided by ASANPAY to simulate transactions and ensure that everything functions correctly. This step will help you identify any issues that need addressing before you start accepting real payments.

Step 7: Go Live

Once you’re satisfied with the testing phase, it’s time to activate your Pakistan payment gateway. Update the settings to switch from the sandbox mode to live mode. Congratulations! Your ASANPAY Pakistan payment gateway is now ready to handle transactions.

Step 8: Monitor Transactions

Post-launch, keep a close eye on your transactions through the ASANPAY dashboard. The platform provides real-time analytics and reports, allowing you to track your sales, manage refunds, and analyze customer payment behaviors. Regular monitoring will help you refine your payment processes and enhance customer satisfaction.

By following these steps, you’ll set up ASANPAY smoothly and begin providing your customers with a reliable and efficient payment option. Embracing this modern payment solution not only streamlines your operations but also positions your business for growth in the competitive e-commerce landscape of Pakistan.

Best Practices for Utilizing ASANPAY Effectively

When it comes to maximizing the potential of ASANPAY as your Pakistan payment gateway, implementing best practices can significantly enhance your transaction experience and boost customer satisfaction. Here are some essential tips to utilize ASANPAY effectively:

1. Understand the Integration Process:

Before diving in, take the time to familiarize yourself with the integration documentation provided by ASANPAY. This will help you understand the technical requirements and API functionalities, ensuring a seamless setup on your ecommerce platform. A well-implemented integration minimizes errors during transactions and enhances user experience.

2. Optimize User Experience:

The checkout process is crucial for converting visitors into customers. Ensure that your payment page is user-friendly, with a clear layout that guides users through each step. Minimize the number of fields required for entry and provide multiple payment options to cater to various customer preferences. A smooth, hassle-free experience encourages repeat business.

3. Implement Security Measures:

Trust is paramount in online transactions. Make sure to utilize ASANPAY’s security features, such as encryption and secure payment links, to protect customer data. Display trust badges and security seals on your payment page to reassure customers that their information is safe, thereby reducing cart abandonment rates.

4. Stay Updated with Compliance Regulations:

Ensure your payment processes comply with local regulations and industry standards. Keeping abreast of any changes in laws related to online payments in Pakistan will help you avoid potential legal issues and maintain customer confidence in your services.

5. Monitor Transactions and Performance:

Regularly review your transaction reports through the ASANPAY dashboard. Monitoring metrics such as conversion rates, payment failures, and customer feedback will provide insights into your payment process’s effectiveness. Use this data to identify areas for improvement and make necessary adjustments.

6. Provide Excellent Customer Support:

Make sure your customer support team is well-equipped to handle inquiries related to payments. Provide clear information on payment methods, troubleshooting tips for common issues, and a straightforward process for addressing payment disputes. Effective communication can greatly enhance customer satisfaction and loyalty.

7. Leverage Marketing Opportunities:

Utilize the capabilities of ASANPAY to run promotional campaigns. Consider offering discounts or cashback for payments made through the gateway. Not only does this incentivize customers to use ASANPAY, but it also helps boost sales and customer engagement.

By following these best practices, businesses can harness the full potential of ASANPAY, ensuring a smooth, secure, and efficient payment experience for both the merchant and the customer. In doing so, you can build a robust online presence that fosters trust and encourages customer loyalty, setting the stage for long-term success in the competitive e-commerce landscape in Pakistan.

Troubleshooting Common Issues with ASANPAY

When integrating ASANPAY, Pakistan’s leading payment gateway, into your e-commerce platform, you may encounter some common issues that can hinder the smooth processing of transactions. Understanding how to troubleshoot these problems can ensure a seamless experience for both you and your customers.

1. Payment Declined Errors:

One of the most frequent issues users face is payment declines. This can occur for several reasons, such as insufficient funds, incorrect card details, or restrictions set by the issuing bank. To resolve this, ensure that customers double-check their card information and confirm that their accounts are in good standing. Additionally, encourage them to try an alternative payment method if the issue persists.

2. Integration Difficulties:

Sometimes, merchants may experience challenges during the integration process with the ASANPAY API. This could stem from incorrect API keys or misconfigured settings in your e-commerce platform. To troubleshoot, review the integration documentation provided by ASANPAY carefully and verify that all parameters are set correctly. If issues continue, consider reaching out to ASANPAY’s support team for assistance.

3. Delayed Transaction Notifications:

If you’re not receiving instant notifications for transactions, it may lead to confusion regarding order statuses. Delays in notifications could be due to server issues or connectivity problems. To fix this, check your server’s responsiveness and ensure that webhooks are set up correctly in the ASANPAY dashboard. Test the notification system with dummy transactions to confirm it is functioning properly.

4. Currency Mismatch:

If transactions are being processed in an unexpected currency, this could confuse customers and lead to abandoned carts. Ensure that your website is configured to use the correct currency supported by ASANPAY. Adjust the settings in your Pakistan payment gateway integration to align with the currency preferences of your target market.

5. Security Concerns:

As with any online payment system, security is paramount. If you receive alerts about potential security breaches or suspicious activities, investigate them immediately. Always ensure that your website is SSL certified and that you are following best practices for data security to protect both your business and your customers.

By proactively addressing these common issues, you can enhance the reliability of the ASANPAY Pakistan payment gateway and foster a positive user experience. A well-functioning payment system not only builds trust with your customers but also drives repeat business and customer loyalty.